Consumer Energy Efficiency Loan Programs

Go Greener. Affordably.

National Energy Improvement Fund (NEIF) has partnered with cuBIZloan to develop the

Go Greener Lending Program for Credit Unions.

NEIF is interested in exploring immediate forward funding relationships with like-minded Credit Unions for consumer energy efficiency financing programs and potentially for commercial lending.

NEIF’s loan flow consists of both residential and commercial financing, including both:

- Market-based lending and

- Program-sponsored subsidized lending wherein a utility, government or manufacturers supply rate-buydowns, loss coverage or subordinate capital to the lender resulting in lower rates to borrowers for targeted qualifying improvements.

Eligible Home Improvements

Home Improvements are program specific and may include:

- Heating & Cooling

- Electrical, Plumbing, Kitchens & Baths

- Windows, Doors, Siding & Roofing

- Home Performance with ENERGY STAR®

- Air Sealing & Insulation

- Geothermal, Solar & Other Energy Projects

Annual funding commitment from $5 mm or more.

- Loan underwriting matching current NEIF’s successful, long-standing underwriting guidelines.

- NEIF can close in the Credit Union’s name with a fully integrated Memberization processes or in NEIF’s name with simultaneous Memberization and assignment.

- Used for both market-based and potentially buy-down programs and credit enhancement programs through utilities and governments

- Interested in exploring the development of a similar sub-$150k commercial energy efficiency lending program

A Complete Energy Efficiency Program

NEIF’s team has 20-plus year of experience in compliance-focused, setting lending standards for energy efficiency improvements. NEIF provides a turn-key solution for energy efficiency financing including:

- Complete program administration with program partners (utilities, states etc.)

- Contractor recruitment, training and management program

- Program marketing

- Fully compliant origination and all loan servicing and investor reporting

NEIF understands the need for rigid compliance and fair-lending practices as well as the nuances of working with highly regulated institutions.

Managing Risk: Contractor Management and Training

Energy Efficiency Loan Process

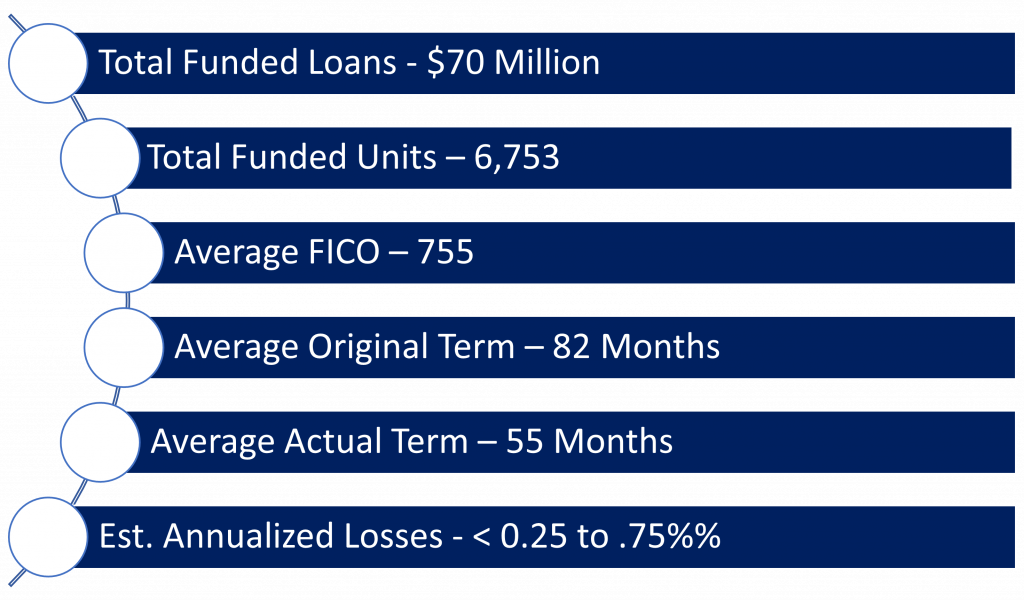

NEIF Consumer Energy Loan Summary

Performance of NEIF’s energy loan programs from 2019-2023 using nominally same standard credit guidelines as proposed.

Electrification is the most exciting transformation of our time:

the shift away from fossil fuels toward an electric-powered future.